Samsung eyes Strategic Deals to Overcome Growth Struggles

KUALA LUMPUR, March 19 – Samsung Electronics is pursuing strategic deals to regain stability after last year’s stock struggles.

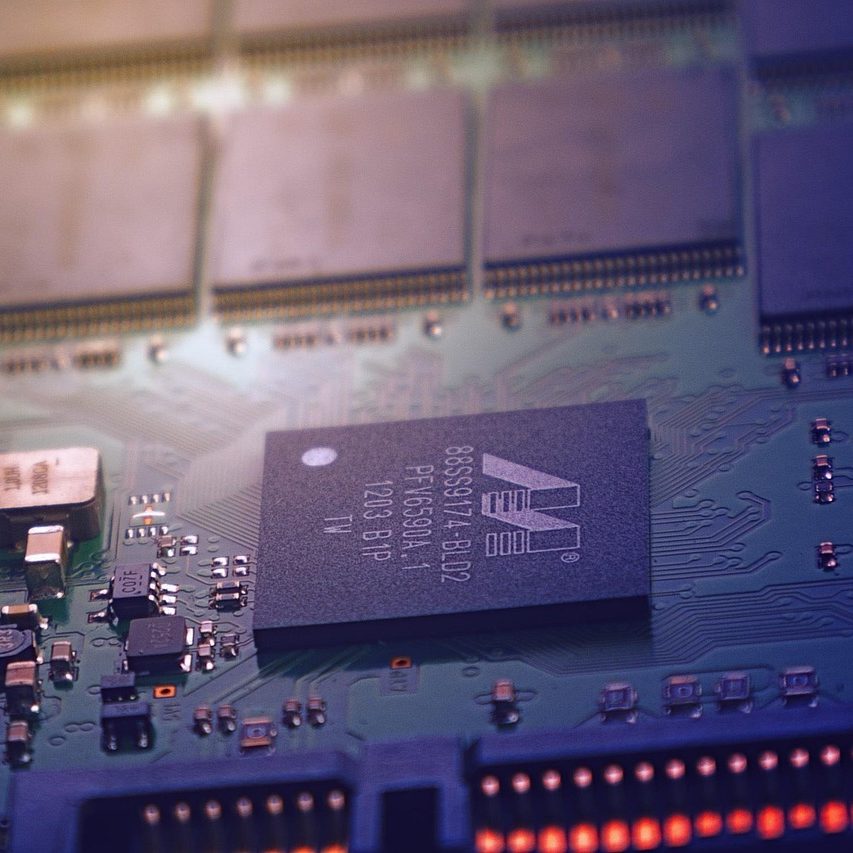

The company fell behind in the AI chip race, making it one of the worst-performing tech stocks in 2023. Shareholders, frustrated with weak earnings and falling stock prices, demanded action at a recent meeting.

Samsung admitted it misread market trends and missed the early AI chip boom. Co-CEO Jun Young-hyun apologized for the stock’s poor performance and promised to catch up in high-bandwidth memory (HBM) chips, which are key for AI processors.

Rivals like SK Hynix gained big in this space while Samsung lagged behind.

Shareholder Pressure

Investors have been vocal about the company’s sluggish stock. A shareholder at the meeting said last year’s performance was so bad, they considered shifting investments to U.S. stocks. In response, Samsung introduced stock-based incentives for executives and is now considering expanding them to employees.

Samsung shares rose 2.3% after the meeting, outpacing the benchmark KOSPI’s 0.9% gain. The company also launched a 10 trillion won ($7.2 billion) share buy-back plan in November to boost confidence among investors.

Pushing for Acquisitions

Samsung knows 2025 will be tough, with economic uncertainties affecting global markets. Co-CEO Han Jong-hee said the company is determined to pursue “meaningful” mergers and acquisitions to address growth concerns.

However, regulatory hurdles and national interests make semiconductor deals tricky.

Internally, Samsung acknowledges it has lost ground in the AI chip race. Nvidia and other AI giants now rely more on SK Hynix for advanced memory chips. The pressure is on for Samsung to make bold moves and regain its competitive edge.