The whole world is awaiting for Trump’s Tariff Announcement

KUALA LUMPUR, 1 April 2025 – Global financial markets are on edge as the world anticipates the rollout of sweeping new U.S. tariff on 2 April, a move dubbed “Liberation Day” by President Donald Trump. The announcement, which is expected to be made in a high-profile ceremony in the White House Rose Garden, is shaping up to be one of the most consequential global trade shifts since the original trade war of 2018–2019.

The administration has confirmed that these “reciprocal tariffs” will apply globally, with no exemptions granted, signaling a seismic shift in U.S. trade policy and prompting widespread concern across sectors and borders.

Tariffs Without Borders

The new tariffs are set to target key strategic industries, including:

- 25% on all auto imports, potentially impacting Japanese, Korean, and German manufacturers;

- Tariffs reinstated on Canada and Mexico, previously paused under earlier trade deals;

- 20% on Chinese goods, linked to fentanyl production concerns;

- 25% tariffs on countries importing oil from Venezuela, including European and Asian nations;

- Additional levies on semiconductors, pharmaceuticals, copper, and lumber.

While the administration argues this will “restore fair trade and protect American jobs,” economists warn of widespread ripple effects, including increased consumer prices, supply chain disruptions, and a rise in global protectionism.

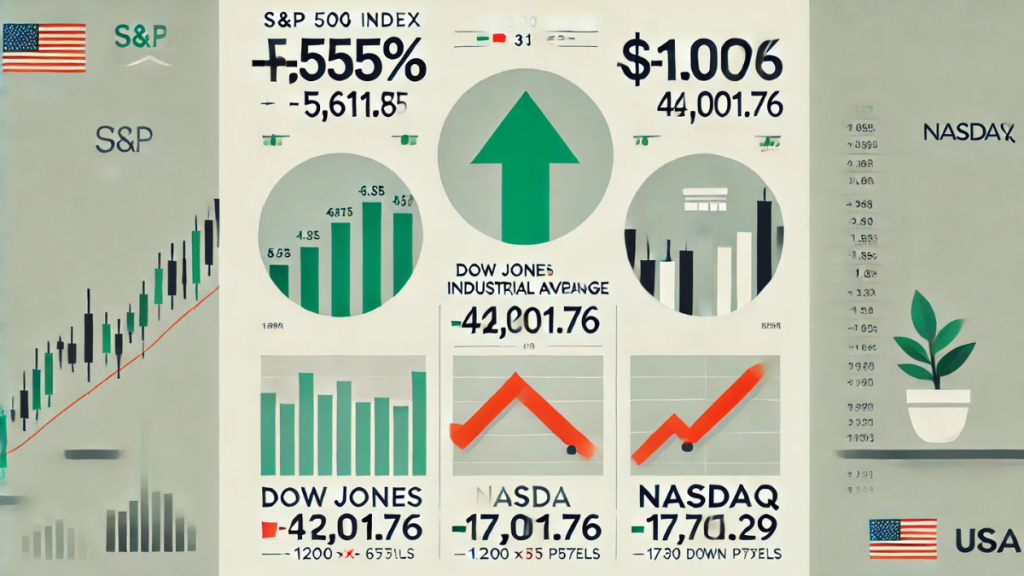

Markets Already Reacting

Wall Street responded swiftly to early signals of the announcement. In the final week of March:

- The S&P 500 fell by 4.6%, its worst quarter since 2022.

- The Nasdaq Composite dropped 10.5%, with sharp losses in tech stocks including Tesla and Nvidia.

- Conversely, energy stocks surged 9.3%, reflecting anticipated volatility in global oil supply chains.

Market analysts have described the environment as a “high-volatility zone” where uncertainty dominates investor sentiment. Asian markets, including the FBM KLCI, also showed minor declines amid fears of secondary impact.

Malaysia and ASEAN on Alert

For Malaysia, the upcoming tariffs carry mixed implications. On one hand, the region’s export-reliant economies could see trade diverted or dampened due to increased U.S. barriers. On the other, supply chain shifts could benefit ASEAN countries if companies look to “friend-shore” operations away from tariff-affected zones like China.

Trade policy experts suggest that Malaysia’s electronics, automotive components, and palm oil exports may face short-term turbulence, while the broader risk lies in reduced investor confidence and volatility in the ringgit.

“We expect Malaysian exporters to recalibrate pricing and sourcing strategies quickly,” said an analyst from MIDF Research. “Trade diplomacy will be critical in the weeks ahead.”

White House’s Justification: Economic Nationalism

The Trump administration has positioned the new tariffs as a defensive measure to correct what it views as decades of “unfair trade deficits and foreign dependency.” In a press briefing, officials reiterated that this is about ensuring “American strength, independence, and industrial revival.”

Yet global observers have cautioned that these policies may trigger tit-for-tat retaliations, potentially reigniting a full-scale trade war.

What Happens Next

The tariff announcement is scheduled for 2 April 2025 at the White House, and implementation is expected to begin shortly after. Analysts say the true test will be in how U.S. trade partners respond, particularly China, the EU, Japan, and ASEAN nations.

Financial institutions are advising businesses to prepare for supply chain realignments, price adjustments, and greater trade compliance scrutiny. Consumers should also expect potential price hikes on electronics, cars, pharmaceuticals, and imported goods.

Brace for Global Recalibration

As the U.S. presses forward with one of the boldest tariff moves in modern history, the world—Malaysia included—must prepare for a period of economic recalibration, trade tension, and policy adaptation.

ForwardMalaysia.my will continue to monitor the impact of “Liberation Day” and provide real-time analysis on how it reshapes global trade, regional economics, and Malaysia’s role in a transforming global marketplace.